Choosing the right maternity coverage can be a pivotal decision for expecting parents. With various options available, it’s important to find a plan that aligns with your needs and offers comprehensive benefits. This article explores the top maternity insurance plans, focusing on factors like pregnancy insurance, delivery coverage, and postpartum care. We’ll also touch on how these plans cater to different situations, such as maternity insurance for self-employed individuals and those seeking maternity insurance for small businesses.

Understanding Maternity Insurance

Maternity insurance is designed to cover the costs associated with pregnancy and childbirth. It typically includes coverage for hospital stays, pregnancy medications, and prenatal care. When evaluating different plans, it’s crucial to understand what each plan offers in terms of pregnancy-related expenses and delivery coverage.

Evaluating Pregnancy Insurance Plans

When selecting a pregnancy insurance plan, consider the following aspects:

Hospital Stay Coverage: Ensure that the plan covers hospital stays during delivery and any potential complications. This is essential for managing pregnancy-related expenses effectively.

Prenatal and Postpartum Care Coverage: Comprehensive plans should include prenatal care coverage for regular check-ups and postpartum care coverage to support recovery after childbirth.

Newborn Care Coverage: Look for plans that offer newborn care coverage to ensure that your baby receives the necessary medical attention.

Types of Maternity Coverage

Maternity Health Insurance

Maternity health insurance is designed specifically to cover the costs associated with pregnancy and childbirth. It provides a range of benefits, including delivery coverage, hospital stay coverage, and pregnancy medications. This type of insurance is crucial for managing the financial aspects of pregnancy and ensuring access to necessary medical care.

Pregnancy Insurance

Pregnancy insurance often includes similar benefits as maternity health insurance but may be structured differently depending on the provider. When comparing pregnancy insurance plans, consider the extent of coverage for prenatal visits, delivery, and postpartum care.

Comparing Maternity Insurance Plans

To find the best maternity insurance plan, compare the following factors:

Maternity Insurance Cost: Evaluate the premium and out-of-pocket costs associated with each plan. Consider how these costs align with your budget and financial situation.

Coverage for Pregnancy Complications: Ensure the plan covers pregnancy complications that may arise, providing peace of mind in case of unexpected medical needs.

Fertility Treatment and Adoption Coverage: Some plans include coverage for fertility treatments and adoption, which can be beneficial if you require additional assistance or plan to expand your family through adoption.

Specialized Maternity Coverage Options

Maternity Insurance for Self-Employed and Freelancers

For those who are self-employed or work as freelancers, finding the right maternity insurance can be challenging. Maternity insurance for self-employed individuals and pregnancy insurance for freelancers should offer comprehensive coverage while fitting within a variable income structure. Look for plans that offer flexibility and support for various needs.

Maternity Insurance for Small Businesses and Startups

Maternity insurance for small businesses and pregnancy insurance for startups is crucial for business owners who need to manage their personal health while running a company. These plans should provide robust coverage and consider the unique needs of small business owners.

Maternity Insurance for Entrepreneurs and Gig Workers

Entrepreneurs and gig workers may require maternity insurance for entrepreneurs and pregnancy insurance for gig workers that accommodate irregular work schedules and income. Finding a plan with flexible terms and comprehensive coverage is essential for managing both work and pregnancy.

Surrogacy and Adoption Coverage

If you are considering surrogacy or adoption, make sure your maternity insurance plan includes relevant coverage. Surrogacy coverage should address medical expenses related to the surrogate, while adoption coverage should cover costs associated with adopting a child.

Assessing Maternity Insurance Providers

When choosing a maternity insurance provider, review their offerings and customer feedback:

Maternity Insurance Reviews: Look for reviews and ratings to gauge the quality of coverage and customer service.

Maternity Insurance Quotes: Obtain quotes from multiple providers to compare costs and benefits.

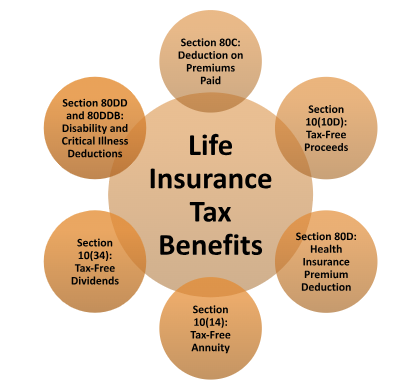

Tax Benefits and Financial Planning

Consider potential tax benefits associated with maternity insurance. In some cases, premiums and out-of-pocket expenses may be deductible, providing additional financial relief.

Essential Features to Seek in Maternity Coverage

Navigating the world of maternity insurance can be overwhelming, especially when trying to ensure comprehensive care during pregnancy. Whether you are self-employed, a freelancer, or running a small business, finding the right maternity coverage is crucial. This article will guide you through the essential features to look for in maternity insurance to ensure you receive the best care throughout your pregnancy. We’ll also touch upon various aspects such as pregnancy-related expenses, delivery coverage, and hospital stay coverage, with a focus on specific cities like Tulsa, Lexington, Akron, Hartford, and Jacksonville.

Understanding Maternity Insurance

Maternity insurance provides coverage for various aspects of pregnancy, from prenatal care to delivery and postpartum care. The primary goal is to ensure that you are financially protected and have access to the necessary medical services throughout your pregnancy. Here are the essential features to look for in a comprehensive maternity health insurance plan.

Prenatal Care Coverage

Prenatal care coverage is one of the most critical components of maternity insurance. This includes regular check-ups, screenings, and tests that are necessary to monitor the health of both the mother and the baby. Ensure that your pregnancy insurance plan covers:

- Routine Doctor Visits: Regular check-ups with your obstetrician or midwife.

- Ultrasounds and Tests: Necessary imaging and diagnostic tests to track fetal development and detect potential issues.

- Vaccinations: Coverage for recommended vaccinations during pregnancy.

Pregnancy Medications

During pregnancy, certain medications and supplements are crucial for both maternal and fetal health. Ensure that your pregnancy health insurance plan includes coverage for:

- Prenatal Vitamins: Essential for the health of both the mother and the baby.

- Prescription Medications: Any necessary prescriptions for pregnancy-related conditions.

Delivery Coverage

Delivery coverage is a fundamental aspect of any maternity insurance plan. This should include:

- Hospital Stays: Coverage for the length of your hospital stay during labor and delivery.

- Labor and Delivery Costs: Ensure that the plan covers the costs associated with childbirth, including both vaginal and cesarean deliveries.

- Anesthesia and Pain Management: Coverage for epidurals or other pain management techniques used during delivery.

Postpartum Care Coverage

Postpartum care is essential for the recovery of the mother and the initial care of the newborn. Your maternity insurance should include:

- Postpartum Check-Ups: Follow-up visits with your healthcare provider to monitor recovery.

- Mental Health Support: Coverage for counseling or therapy if needed.

- Breastfeeding Support: Access to lactation consultants or breastfeeding classes.

Newborn Care Coverage

Once the baby arrives, it is crucial to have newborn care coverage. This should cover:

- Initial Pediatric Visits: Regular check-ups to ensure the newborn’s health and development.

- Vaccinations: Necessary immunizations for the newborn.

- Emergency Care: Coverage for any unexpected health issues that arise in the newborn.

Maternity Leave Insurance

Maternity leave insurance provides financial support during your time off from work. Key features to consider include:

- Income Replacement: Coverage that provides a portion of your income while you are on maternity leave.

- Flexible Leave Options: Plans that offer flexibility in terms of the duration of leave.

Pregnancy Complications Coverage

Complications during pregnancy can lead to significant medical expenses. Ensure your pregnancy insurance covers:

- High-Risk Pregnancies: Additional care and monitoring for conditions that may pose risks.

- Emergency Procedures: Coverage for any emergency interventions required during pregnancy.

Fertility Treatment and Surrogacy Coverage

If fertility treatments or surrogacy are part of your pregnancy journey, make sure your maternity insurance plan includes:

- Fertility Treatments: Coverage for treatments such as IVF or other assisted reproductive technologies.

- Surrogacy Coverage: If using a surrogate, ensure that all associated costs are covered by the insurance.

Adoption Coverage

For those who choose adoption, it’s important to have adoption coverage. This can include:

- Adoption Expenses: Financial support for the legal and administrative costs of adoption.

- Post-Adoption Support: Coverage for any medical needs of the adopted child.

Cost Considerations

Understanding the maternity insurance cost is essential for budgeting and planning. When comparing maternity insurance quotes, consider:

- Premiums: The amount you pay regularly for your insurance coverage.

- Deductibles and Co-Pays: Out-of-pocket costs you will need to pay before the insurance kicks in.

- Coverage Limits: The maximum amount the insurance will pay for various services.

Finding the Best Maternity Insurance Providers

Choosing the right maternity insurance provider involves evaluating various plans based on your specific needs. Here are some tips:

- Maternity Insurance Reviews: Look for reviews and feedback from other policyholders to gauge the quality of coverage.

- Comparison Tools: Use maternity insurance comparison tools to evaluate different plans side by side.

Special Considerations for Specific Groups

If you fall into specific categories such as self-employed individuals or small business owners, there are tailored maternity insurance plans available. Ensure that:

- Maternity Insurance for Self-Employed: Plans are designed to accommodate the unique needs of self-employed individuals.

- Maternity Insurance for Small Businesses: Coverage options are available for employees of small businesses.

Strategies for Finding Affordable Maternity Coverage

Finding the right maternity coverage can be a daunting task, especially when balancing affordability with quality. Whether you're expecting or planning, securing the best maternity insurance is crucial for managing pregnancy-related expenses and ensuring comprehensive care. This article explores effective strategies for finding affordable maternity coverage without sacrificing the quality of care, with a focus on cities like Tulsa, Lexington, Akron, Hartford, and Jacksonville.

Understanding Maternity Insurance Needs

Before diving into strategies, it’s essential to understand what maternity insurance typically covers. A good plan should address various aspects of pregnancy and childbirth, including:

- Pregnancy medications

- Prenatal care coverage

- Delivery coverage

- Hospital stay coverage

- Postpartum care coverage

- Newborn care coverage

Evaluating your needs for each of these components will help you identify a policy that offers the best balance of cost and coverage.

Comparing Maternity Insurance Plans

When searching for affordable maternity insurance, comparison is key. Here’s how to effectively compare different plans:

Maternity Insurance Quotes: Start by gathering maternity insurance quotes from multiple providers. This will give you a range of options and help you find competitive rates.

Maternity Insurance Comparison: Use comparison tools and resources to evaluate the benefits and costs of various maternity insurance plans. Look for plans that offer comprehensive pregnancy coverage while keeping premiums reasonable.

Maternity Insurance Reviews: Reading maternity insurance reviews can provide insights into the experiences of other policyholders. This information can help you assess the reliability and quality of different insurers.

Evaluating Coverage for Pregnancy-Related Expenses

To ensure your pregnancy health insurance provides value, check how it handles specific pregnancy-related expenses:

Fertility Treatment Coverage: If you need fertility treatment coverage, make sure the plan includes this in its benefits. Fertility treatments can be costly, and having adequate coverage is crucial.

Pregnancy Complications Coverage: Verify that the plan covers complications that might arise during pregnancy. This includes coverage for any unexpected medical issues.

Maternity Leave Insurance: Some policies offer benefits that support income replacement during maternity leave. Consider these options to manage your finances during this period.

Exploring Specialized Coverage Options

Depending on your specific needs, you might require specialized coverage:

Maternity Insurance for Self-Employed: If you are self-employed, look for maternity insurance for self-employed individuals. These plans often have different structures and benefits compared to standard plans.

Pregnancy Insurance for Freelancers: Freelancers might find pregnancy insurance for freelancers that caters specifically to their unique working arrangements and income stability.

Maternity Insurance for Small Businesses: Small business owners should explore maternity insurance for small businesses, which can offer tailored coverage for employees.

Maternity Insurance for Remote Workers: Remote workers may benefit from maternity insurance for remote workers, which includes coverage for remote work scenarios.

Navigating Maternity Coverage for Self-Employed Professionals

For self-employed professionals, securing appropriate maternity insurance can be a challenging yet crucial task. With the unique needs of freelancers, entrepreneurs, and gig workers, understanding the options available and how to manage pregnancy-related expenses is essential. This guide explores how self-employed individuals can navigate maternity coverage, including the various types of insurance plans and considerations for finding the best fit.

Understanding Maternity Coverage

Maternity coverage is a crucial aspect of pregnancy insurance that helps cover the costs associated with pregnancy and childbirth. For those who are self-employed, obtaining the right coverage is essential not only for managing medical costs but also for ensuring comprehensive care throughout pregnancy. This coverage typically includes:

Delivery Coverage: This includes the costs associated with labor and delivery, such as hospital fees and medical procedures.

Hospital Stay Coverage: Ensures that you have financial support for the duration of your hospital stay, which can vary depending on the type of delivery and any complications.

Pregnancy Medications: Coverage for any medications prescribed during pregnancy, including prenatal vitamins and other necessary drugs.

Prenatal Care Coverage: Includes routine check-ups and screenings to monitor the health of both the mother and the baby.

Postpartum Care Coverage: Provides support for medical care needed after delivery, including follow-up visits and any required treatments.

Newborn Care Coverage: Covers the initial medical expenses for the newborn, including routine examinations and any necessary treatments.

Challenges for Self-Employed Professionals

Self-employed individuals, including freelancers and entrepreneurs, face unique challenges when it comes to maternity insurance. Unlike employees of large organizations who often receive comprehensive benefits, self-employed professionals must find and manage their own insurance coverage. Here are some key considerations:

Cost of Maternity Insurance: Maternity insurance cost can be a significant concern. Premiums for maternity health insurance can vary widely based on coverage options and the individual's health status.

Coverage Options: Understanding the different types of maternity insurance plans available is essential. This includes comparing pregnancy insurance plans and selecting one that best meets your needs.

Maternity Leave Insurance: If you are planning to take time off during and after pregnancy, maternity leave insurance can help replace lost income. It's important to ensure that your plan includes this benefit.

Choosing the Right Maternity Insurance Plan

Selecting the right maternity insurance involves comparing various plans and providers. Here’s what to consider:

Maternity Insurance Providers: Research and compare maternity insurance providers to find those that offer comprehensive coverage and favorable terms.

Maternity Insurance Quotes: Obtain maternity insurance quotes from multiple providers to find the best rates. Comparing quotes can help you find affordable options that fit your budget.

Maternity Coverage Comparison: Review different maternity insurance plans and their benefits. Maternity insurance comparison helps you understand what is included and how it meets your needs.

Pregnancy Insurance Reviews: Look at pregnancy insurance reviews to gauge the experiences of others with specific plans and providers.

Special Considerations for Different Needs

Depending on your personal and professional situation, you may have specific needs for your maternity coverage. Here are some additional factors to consider:

Fertility Treatment Coverage: If you require fertility treatments, ensure that your plan includes fertility treatment coverage. This is particularly important if you have specific reproductive health needs.

Adoption and Surrogacy Coverage: If you are considering adoption or surrogacy, explore plans that offer adoption coverage and surrogacy coverage.

Pregnancy Complications Coverage: For those at higher risk of complications, it’s crucial to have coverage for pregnancy complications. This ensures that you are financially protected in case of unexpected medical issues.

Self-Employed Specific Insurance Options

As a self-employed professional, you have several options for obtaining maternity insurance:

Maternity Insurance for Freelancers and Gig Workers: Look for plans specifically designed for maternity insurance for freelancers and pregnancy insurance for gig workers. These plans cater to the needs of those who do not have a traditional employer-based health plan.

Maternity Insurance for Small Businesses and Startups: If you run a small business or startup, consider maternity insurance for small businesses and pregnancy insurance for startups. These plans often offer group coverage options that can be more affordable.

Maternity Insurance for Entrepreneurs and Remote Workers: For maternity insurance for entrepreneurs and pregnancy insurance for remote workers, look for plans that provide flexibility and comprehensive coverage suited to your working style.

Understanding the Crucial Benefits of Having Maternity Coverage

Maternity coverage is a critical component of comprehensive pregnancy insurance and maternity health insurance. It encompasses various aspects of pregnancy, from prenatal care to postpartum support, and ensures that expectant and new parents are financially protected throughout this transformative period. This article explores the essential benefits of having maternity coverage and how it impacts pregnancy-related expenses. Targeting cities like Tulsa, Lexington, Akron, Hartford, and Jacksonville, we’ll delve into the advantages of maternity insurance and how it can be tailored to meet individual needs.

Comprehensive Coverage for Pregnancy and Delivery

One of the foremost benefits of maternity insurance is the comprehensive coverage it provides for pregnancy and delivery. This includes delivery coverage, which helps offset the costs associated with childbirth, whether through a vaginal delivery or a cesarean section. Additionally, hospital stay coverage ensures that the expenses incurred during your hospital stay are covered, reducing out-of-pocket costs significantly.

Maternity health insurance plans often include coverage for a range of services such as prenatal visits, necessary pregnancy medications, and any pregnancy complications coverage that may arise. This holistic approach ensures that both the mother and baby receive the necessary care throughout the pregnancy.

Financial Protection Against High Costs

Pregnancy can be an expensive journey, with costs accumulating from prenatal care to postpartum support. Maternity insurance plays a crucial role in alleviating the financial burden by covering various pregnancy-related expenses. This includes costs for routine doctor visits, diagnostic tests, and any unexpected medical issues.

The maternity insurance cost varies depending on the coverage level and provider, but investing in a robust policy can save substantial amounts in the long run. Pregnancy insurance quotes can help you compare plans and find one that fits your budget while providing comprehensive coverage.

Support for Postpartum and Newborn Care

After delivery, postpartum care coverage becomes vital. This coverage addresses the health needs of new mothers during the recovery period, which may include consultations, mental health support, and any necessary treatments.

Additionally, newborn care coverage ensures that the baby receives the necessary medical attention right from birth. This can include routine check-ups, vaccinations, and any special care required if the baby has health issues.

Tailored Coverage Options

Maternity insurance plans come in various forms, allowing individuals to choose the coverage that best suits their needs. For those who are self-employed or run small businesses, options like maternity insurance for self-employed or maternity insurance for small businesses are available. These plans cater specifically to the needs of freelancers, startups, and entrepreneurs.

For families, family floater health insurance is an option that provides coverage for multiple members under a single plan, including maternity benefits. This can be particularly useful for those managing multiple coverage needs within the family.

Additional Benefits and Special Cases

Maternity coverage can also extend to various special cases, such as:

Fertility treatment coverage: If fertility treatments are necessary, certain maternity insurance plans may offer coverage for these expenses.

Adoption and surrogacy coverage: For those considering adoption or surrogacy, specific plans can help manage the associated costs, providing financial support during these processes.

Health insurance for senior citizens: While this primarily focuses on older individuals, there are also plans that integrate maternity benefits for seniors who are expecting or adopting.

Choosing the Right Maternity Insurance

When selecting maternity insurance, consider the following:

Coverage comparison: Utilize tools and resources for maternity insurance comparison to evaluate different plans based on coverage, cost, and benefits.

Provider reviews: Look into maternity insurance reviews to gauge the reliability and customer satisfaction associated with various insurance providers.

Customized plans: Tailor your pregnancy insurance plans to your specific needs, whether it’s comprehensive coverage or a plan that focuses on specific aspects of maternity care.

.jpg)

English (US) ·

English (US) ·